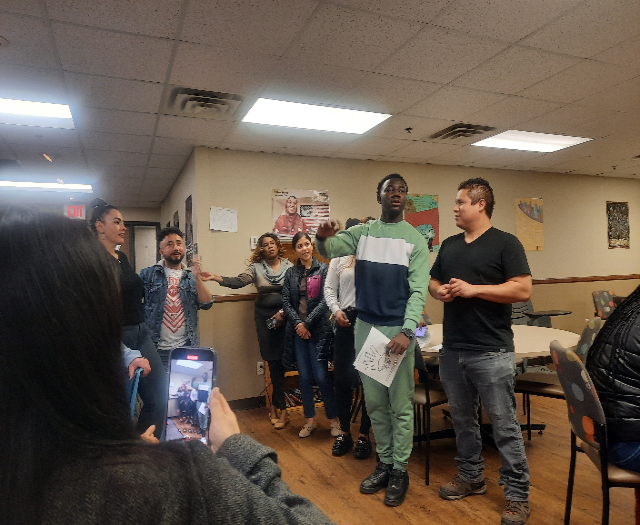

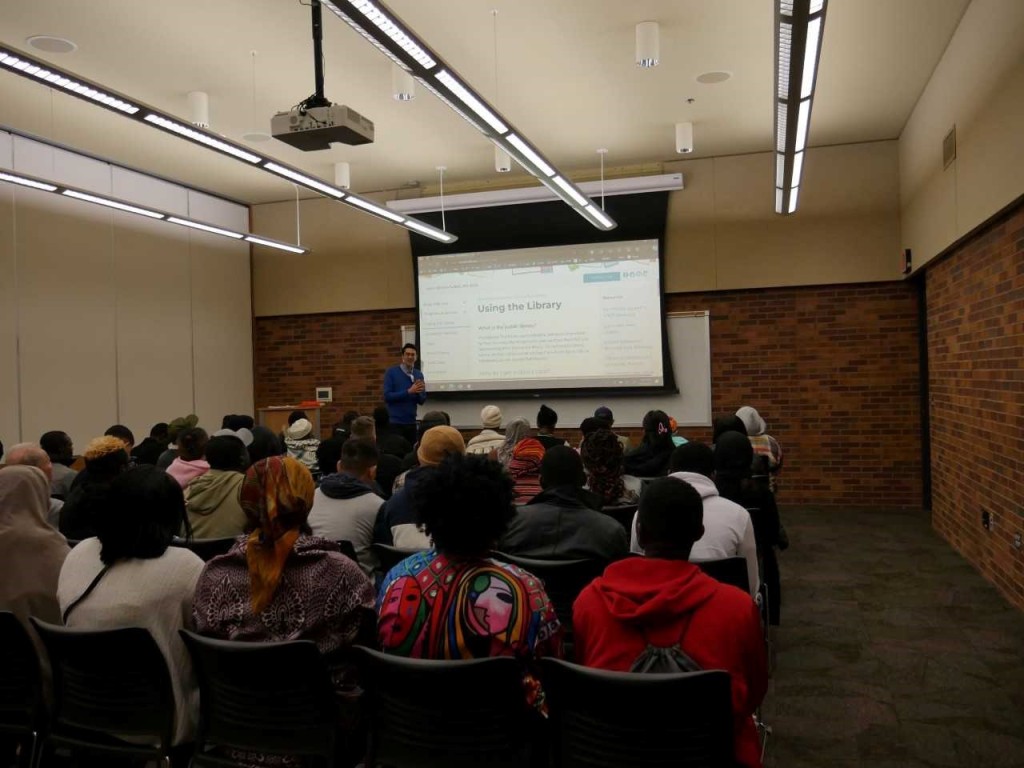

In October, a group of students at LSS Center for New Americans went to Siouxland Libraries Downtown Library. The purpose of the trip was for students to explore the library, see the different resources available, talk to librarians and of course, get library cards and check out books. At the library, the students were greeted warmly by a knowledgeable staff who patiently answered their questions and helped them find the books they were looking for.

Our students all had different things they wanted at the library. One student found books to help him prepare for the TOFEL and IELTS exams, two rigorous international exams that test English language proficiency. Another student was looking for children’s books in Spanish. The student, herself a Spanish speaker, has children learning Spanish in school and wanted something to bolster their studying at home. Other students chose books based on their own interests whether it be science, fairy tales and everything in between.

The students and teachers both thoroughly enjoyed their visit. LSS ESL Instructor Heather Glidewell noted, “The students were super excited to be able to bring home books and become acquainted with resources in the community.” All in all, 101 students visited and many of those students got signed up for their first Sioux Falls library card. Thank you very much to Siouxland Libraries for hosting us. We look forward to visiting again next year!

Kate Harris ESL Instructor & Career Navigator

Pronouns: she/her/hers

LSS Center for New Americans

P: 605-731-2000 | F: 605-731-2059

Posted by lsssdblog

Posted by lsssdblog